Punjab State Board PSEB 10th Class Social Science Book Solutions Economics Chapter 1 Basic Concepts Textbook Exercise Questions and Answers.

PSEB Solutions for Class 10 Social Science Economics Chapter 1 Basic Concepts

SST Guide for Class 10 PSEB Basic Concepts Textbook Questions and Answers

Very Short Answer Type Questions

Question 1.

Define national income.

Answer:

According to Dernburg, “National income may be defined as the factor income in the form of rent, wages, interest and profit of the normal residents of a country in one year. It is composed of domestic factor income and net factor income from abroad.”

Question 2.

Define per capita income.

Answer:

Per capita income is the average income of the people of a country in a definite period of time. In other words,

Per Capita Income = \(\frac{\text { National Income }}{\text { Population }}\)

Question 3.

What is meant by consumption?

Answer:

Use of goods and services produced in order to satisfy human wants is called as consumption. In other words, consumption means expenditure made on consumption during one year in an economy.

Question 4.

What is meant by average propensity to consume?

Answer:

Average propensity to consume is the ratio of consumption to income. In other words,

Average Propensity to Consume = \(\frac{\text { Consumption }}{\text { Income }}\)

Question 5.

Define Investment.

Answer:

An addition to capital is called investment. During a year that part of income which is not spent on consumption but is saved for the use of capital formation is called investment.

Question 6.

What is meant by induced investment?

Answer:

Induced investment is that investment which depends upon the level of income and profit. Most of the private investment is induced investment.

Question 7.

What is meant by autonomous investment?

Answer:

That investment which is independent of the changes in the level of income, output and profits, is called as autonomous investment. Most of public investment or government investment is autonomous investment.

![]()

Question 8.

What is capital formation?

Answer:

Net investment in fixed assets, i.e., additions to the stock of physical and human capital, is known as capital formation.

Question 9.

What is meant by disguised unemployment?

Answer:

A person is said to be disguisedly unemployed if his contribution in the total product is almost zero or negligible. Thie type of unemployment is normally found in most of the agricultural dominated under-developed countries of the world.

Question 10.

Define full employment.

Answer:

Full employment signifies a situation in which all those who are willing to work at the current wage rate get work.

Question 11.

What is meant by inflation?

Answer:

Inflation signifies increase in the level of prices and consequent deterioration in the value of money over a period of time. In the words of Crowther, “Inflation is a state in which the value of money is falling, i.e., prices are rising.”

Question 12.

What is meant by supply of money?

Answer:

Generally money supply means currency and deposits of banks available with the people of the country. Broadly speaking, there are two constituents of money supply:

- Currency and

- Bank deposits.

Question 13.

Write a note on the government budget.

Answer:

Government Budget is an annual statement of estimated revenue and expenditure of the government. Indian Government generally present its budget in Lok Sabha on Feb 28th of every year.

The government budget can be of three types:

- Balanced Budget

- Surplus Budget &

- Deficit Budget.

Question 14.

What is meant by deficit financing?

Answer:

Deficit financing is the method by which government meets the budgetary deficits by taking loans from the Central Bank. Central Bank meets this deficit by printing new currency notes. In the same way when aggregate expenditure exceeds aggregate revenue then the government has to face deficit.

![]()

Question 15.

How many people are considered to be below poverty line in India?

Answer:

The Planning Commission has defined the poverty line on the basis of the ‘ recommended nutritional intake of 2,400 calories per person per day for rural areas and 2,100 calories for urban areas. On this basis, in rupee terms, the poverty line works out at? 972 per head per month for rural areas and at? 1407 per head per month for urban areas, both at the 2013-14 prices. In the year 2014-15 in India 29.8 percent people were below poverty line.

Question 16.

How growth rate is determined?

Answer:

Growth rate is that percentage rate from which it is known that in comparison to one year how much percentage change has taken place in national income or per capita income in any other year.

It is calculated by using following formula:

Growth Rate = Change in Per Capita Income × 100/Original Capita Income.

Question 17.

What is meant by foreign aid?

Answer:

By foreign aid, we mean the inflow of external assistance in the form of foreign capital, loans, grants apd assistance by foreign countries, private individuals, business organisations, foreign banks and international organisations.

Question 18.

Define balance of payments.

Answer:

Balance of payments is a statement of systematic record of all economic transactions between one country and the rest of the world (or foreign countries). Thus the account of receipts and payments of the government of one country from other countries during a period of one year is called Balance of Payments. In the words of Kindleberger, “Balance of payments is a systematic record of all economic transactions between the residents of the reporting country and residents of foreign countries during a given period of time.”

Question 19.

What is meant by fiscal policy?

Answer:

The policy of the government regarding income and expenditure is known as fiscal policy. As a matter of fact, fiscal policy is the policy of any govt, regarding its expenditure, taxation, borrowing, budget to achieve the various macro-economic objectives.

Short Answer Type Questions

Question 1.

Define National Income. What is the difference between National Income and Domestic Income?

Answer:

National income is defined as the sum total of factor incomes viz. rent, wages, interest and profit accruing to the normal residents of a country for their productive services during a definite period of time i.e. one year. Income is a flow. Thus national income is the earned income by the normal residents of a country during one year. Domestic income equals national income minus net factor income from abroad. In other words,

Domestic Income = National Income – Net Factor Income From Abroad Net factor income from abroad is the difference between the income received by the residents of a country from abroad for providing factor services and the income paid for the factor services provided by the non-residents in the domestic territory of a country.

![]()

Question 2.

What is meant by Per Capita Income? How can you estimate Per Capita Income?

Answer:

Per capita income is considered to be a better measure of economic progress as compared to that of national income.

Per capita income is the average income of the people of a country in a definite period. Obviously per capita income is the average income. Thus, per capita income does not mean that each and every individual of the country is having income equal to it. Some people might be having income greater than it and some less than it. For example, the per capita income of India at current prices in 2013-14 was ₹ 74380 and that of Punjab was ₹ 74606.

Per capita income can be calculated by dividing national income by the population.

In other words,

Per Capita Income = \(\frac{\text { National Income }}{\text { Population }}\)

Question 3.

What do you mean by Consumption? Define Average Propensity to Consume and Marginal Propensity to Consume.

Answer:

The word consumption is used in two senses viz. a process and an expenditure. Thus consumption is that process which satisfies human wants directly like the use of food for the satisfaction of hunger. In the expenditure sense consumption means that total expenditure which is incurred on the consumption goods.

Average propensity to consume is defined as the ratio of consumption to income.

According to Prof. Peterson, “A.P.C. is the proportion of a given income that is spent for consumption purposes.” In other words,

A.P.C = \(\frac{\text { Consumption }}{\text { Income }}\)

Marginal Propensity to Consume (M.P.C.) is defined as the ratio of change in consumption to change in income.

According to Prof. Kurihara, “M.P.C. is the ratio of change in consumption to change in income.” In other words,

Question 4.

What do you mean by Savings? Define Average Propensity to Save and Marginal Propensity to Save.

Answer:

Saving is the difference between income and consumption. In the words of Keynes, “Saving is the excess of income overconsumption.” In other words,

Saving = Income – Consumption

Average Propensity to Save (A.P.S.): A.P.S. is the ratio of saving to income. In other words,

A.P.C = \(\frac{\text { Saving }}{\text { Income }}\)

Marginal Propensity to Save (M.P.S.): M.P.S. is defined as the ratio of change in saving to change in income. In other words,

M.P.S = \(\frac{\text { Change in Saving }}{\text { Change in Income }}\) or \(\frac{\Delta \mathrm{S}}{\Delta \mathrm{Y}}\)

Question 5.

Define investment. What are the elements of determining the Investment?

Answer:

Investment, in economics, signifies nothing but addition to capital. It is defined as the surplus of total production over total consumption. Investment is necessary for increasing the production capacity in the economy. According to Mrs. Joan Robinson, “By investment is meant an addition to capital, such as occurs when a new house is built or a new factory is built. Investment means making an addition to the stock of goods in existence.”

Determinants of Investment: Investment primarily depends upon two factors :

- Expected rate of profitability or Marginal Efficiency of Capital (M.E.C.),

- Rate of Interest or Cost of Investment.

A rational businessman will invest only if M.E.C. is more than the rate of interest. On the contrary, if the rate of interest seems to be greater than M.E.C., then there will be no inducement to invest.

Question 6.

What is meant by Capital Formation? What is the difference between Gross Capital Formation and Net Capital Formation?

Answer:

In economic term that part of income by which more production is possible than before, is called capit’al formation. In other words, an addition to capital stock is called capital formation.

Gross capital formation: Gross capital formation signifies gross investment which includes within itself net investment and depreciation.

Net capital formation. Net capital formation signifies nothing but net investment.

Net capital formation = Gross capital formation – Depreciation

As a matter of fact, capital formation means increase in net investment.

Question 7.

Define disguised unemployment. Explain it with the help of an example.

Answer:

Disguised employment is that situation when more number of labourers are engaged in a work than actually required for it. It means there are some extra or excess workers engaged in that work. This can be explained with the help of an example. Suppose any family has a farm of 3 acres. Three members of that family can work efficiently in this farm with the existing methods of cultivation. But if that family has 6 “members and due to the shortage of employment opportunities in other fields, all of the 6 workers are employed in that farm, then it will be said that out of these 6 the 3 workers are actually disguisedly unemployed.

![]()

Question 8.

What is meant by full employment? What is the meaning of Structural Unemployment and Technical Unemployment?

Answer:

Full employment signifies” a situation in which all those who are willing to work at the current wage rate are able to get work. In other words, full employment means absence of involuntary unemployment.

Structural unemployment. Unemployment which arises due to structural changes in the economy is called as structural unemployment.

Technical unemployment: Unemployment which arises due to changes in the techniques of production is known as technical unemployment.

Question 9.

What is meant by inflation? Explain it.

Answer:

In Economics, the constant rise in prices is called inflation. In the words of Shapiro, “Inflation is a continuous and extreme rise in general price level.”

According to Crowther, “Inflation is a state in which the value of money is falling, i.e., prices are rising.”

From the above definitions, it is clear that inflation is a process of continuous rise in prices and hence fall in the value of money.

There are various causes of inflation. But the main cause of inflation is the excess of demand over supply. When the demand for goods exceeds the supply of goods, prices start rising and hence the problem of inflation arises.

Question 10.

What is Budget? What are the main components of income and expenditure in the budget of Indian Govt.?

Answer:

Budget is a statement of expected income and expected expenditure of the govt, for the given financial year. When the govt, levies taxes and incurs public expenditure, it comes under the purview of budget. Thus govt, budget is a sort of financial plan which includes within itself both income and expenditure. Traditionally, the budget is presented once in a year by the govt. The Govt, of India normally presents the budget in the Lok- Sabha on Feb. 28 or 29.

The main items of budget of the Govt, of India are as follows :

Items of Revenue. “Corporate tax, Income tax, Import and Export duties, Central Excise, Central Sales Tax, Gift tax, etc. are the main sources of income.

Main items of Expenditure. Security, Police, Administration, Education, Health, Social welfare, Industry, Agriculture, Planning, Rural development etc. are the main heads of expenditure.

Question 11.

Define deficit financing. What methods are included in it?

Answer:

Deficit financing is the method by which government meets the budgetary deficits by taking loans from the Central Bank. Dr. V.K.R.V. Rao has defined deficit financing as “the financing of a deliberate created gap between public revenue and public expenditure, the method of financing resorted to being borrowing of a type that results in a net addition to national outlay or aggregate expenditure.”

There are three important techniques through which the govt, may finance its budgetary deficits.

They are as follows:

- Borrowing from Central Bank i.e., creation of new money.

- The running down of accumulated cash balances.

- The govt, may issue new currency.

It is, thus, obvious that all these methods lead to an increase in the supply of money. The increase in money supply normally causes prices to rise. In India, a major part of the budgetary deficit is financed through borrowing from the Central Bank.

![]()

Question 12.

What is meant by Public Finance? Explain direct and indirect taxes, with examples.

Answer:

Public finance deals with the income and expenditure of public authorities. Public authorities include all sorts of governments. Hence it can be said that it deals with the finances of the Govt. Central, State, and Local that are studied in the science of public finance. Prof. Dalton defined public finance as: “It is concerned with the income and expenditure of public authorities and with the adjustment of one to another.” In short, public finance is a study of the nature and principles of state expenditure and state revenue.

Direct Tax: A direct tax is one that cannot be shifted or passed on. It implies that in the case of direct taxes the impact or immediate money burden and the incidence or the ultimate money burden are on the one and the same person. According to Dalton, “A direct tax is really paid by a person on whom it is legally imposed.”

In the group of direct taxes, thus, income tax, wealth tax, property tax, estate duties, capital gains tax may be included.

Indirect Tax: An indirect tax is one that can be shifted or passed on. In case of indirect taxes, the immediate money burden and the ultimate money burden of taxes are on different persons. According to Dalton, “An indirect tax is imposed on one person, but paid partly or wholly by another.” Commodity taxes or sales tax, excise duties, etc. may be grouped as indirect taxes.

Question 13.

What is meant by Public Expenditure? How many types of public expenditure are possible?

Answer:

Public Expenditure: The expenditures incurred by the government are called Public Expenditures.

These can be of four types :

- Public Works. The expenditure incurred on the roads, dams and bridges etc.

- Public Welfare Works. The expenditure incurred on education, public health etc.

- The expenditures on the security and law and order of the country like on Police, Prisons etc.

- The expenditure on subsidies given to the producers to increase production, exports and transfer payments.

Question 14.

Explain the concept of‘Poverty Line’. What are the limits of poverty line in India?

Answer:

The concept of poverty line is used to measure poverty in a country. The people who are living below the poverty line are called as poor.

Poverty line signifies a sum that is needed by a person to meet his minimum consumption needs per month. In other words, by poverty line we mean that sum which is required by a person monthly to meet his minimum needs (food, clothing, housing, education and health, etc.).

Limits of Poverty line in India—In their book “Poverty in India”, V.M. Dandekar and Nilkanth Rath are of the opinion that all those who do not get food worth 2,250 calories are to be considered as poor. In order to get food worth 2,250 calories, the per capita monthly income in the rural areas and the urban areas must be ₹ 15 and ₹ 22.5 respectively at 1960-61 prices.

The Planning Commission has defined the poverty line on the basis of the recommended nutritional intake of 2,400 calories per person per day for rural areas and 2,100 calories per person per day for urban areas. On this basis, in rupee terms, the poverty line works out at ₹ 1407 per head per month for rural areas and ₹ 972 per head per month for urban areas both at the 2013-14 prices. 21.9 per cent of population was below poverty line in India during 2011-12.

Question 15.

Define Growth Rate. How it can be calculated?

Answer:

Growth rate is that percentage rate from which it is known that in comparison to one year how much percentage change has taken place in national income or per capita income in any other year.

Growth rate is calculated by using the following formula:

Per Capita Income Growth Rate = \(\frac{\text { Change in Per Capita Income }}{\text { Original Per Capita Income }}\) × 100

The calculation of growth rate may be made clear with the help of an example. Suppose in 2001 the per capita income of India was ₹ 10,000 and it increased to ₹ 12,000 in 2002. Clearly, the change in per capita income = 12,000 – 10,000 = ₹ 2000.

Initial Per Capita Income = ₹ 10,000

Growth Rate of Per Capita Income = \(\frac{2000}{10,000}\) × 100 = 20%

Thus Growth Rate of Per Capita Income = 20%.

Question 16.

What is meant by foreign aid? What are its main forms?

Answer:

In economics, the term ‘foreign aid’ is interpreted in a wider sense. By foreign aid, we mean foreign capital, foreign loans and foreign grants. In other words, the inflow of external assistance in the form of foreign capital, loans and grants by the foreign governments, private individuals, business organizations, foreign banks, international institutions, is termed as foreign aid.

Types of Foreign Aid-The main kinds of foreign aid are as follows :

- Foreign Capital

- Foreign Loans

- Foreign Grants.

![]()

Question 17.

Define balance of payments. What are the main items of the balance of payments?

Answer:

The account of receipts and payments of the government of one country from other countries during a period of one year is called balance of payments.

According to Kindleberger, “Balance of payments is a systematic record of all economic transactions between the residents of the reporting country and residents of foreign countries during a given period of time.”

Main Items of Balance of Payments. The main items of balance of payments can be divided into two categories :

- Items of current account. The main items of current account are :

(a) The import and export of visible items like machinery, tea, tobacco, etc. The difference between such exports and imports is known as trade balance.

(b) The import and export of invisible items like services of insurance companies, banks, doctors, engineers, government transactions, donations, tourism and shipping, etc. - Items of capital account. The capital account is made up of such terms as the inward and outward flow of money for investment and international grants and loans.

Question 18.

Define monetary policy. What are its main methods?

Answer:

By monetary policy we mean a conscious action undertaken by the Central Bank of the country to change the quality, availability or cost (rate of interest) of money to achieve the various specified economic objectives.

Methods of Monetary Policy. The different methods of monetary policy, also known as instruments of credit control, are as follows :

- Bank Rate

- Open Market Operations

- Changes in Minimum Cash Reserve Ratio

- Change in Liquidity Ratio

- Change in the Margin Requirements of Loan.

The govt, can control the problems of inflation and depression through making suitable changes in these instruments of monetary policy.

PSEB 10th Class Social Science Guide Basic Concepts Important Questions and Answers

Answer the following questions in one word or one line :

Question 1.

What are basic concepts?

Answer:

Those words which have special meaning in economics.

Question 2.

How can per capita income be measured?

Answer:

Per Capita Income = \(\frac{\text { National Income }}{\text { Population }}\)

Question 3.

What is capital formation?

Answer:

It is an addition to capital stock.

Question 4.

What is meant by inflation?

Answer:

Inflation means constant rise in prices.

![]()

Question 5.

What is meant by public debt?

Answer:

It means all types of loans taken by the government.

Question 6.

What is meant by poverty line?

Answer:

It is the method of measuring the poverty of any country.

Question 7.

Which policy is related to the government income and expenditure?

Answer:

Fiscal policy.

Question 8.

Define marginal propensity to consume.

Answer:

It is the ratio of change in consumption to change in income.

Question 9.

What is meant by average propensity to consume?

Answer:

It is the ratio of consumption to income.

Question 10.

What is marginal propensity to save?

Answer:

It is the ratio of change in savings to the change in income.

![]()

Question 11.

Define investment.

Answer:

An addition to capital is called Investment.

Question 12.

What is meant by induced investment,?

Answer:

Induced investment is that which depends upon the level of income and profit.

Question 13.

What is meant by autonomous investment?

Answer:

Autonomous investment is independent of the change in level of income and profit.

Question 14.

State any one component of money supply.

Answer:

Bank deposits.

Question 15.

How is growth rate determined?

Answer:

Growth rate of per capita income = \(\frac{\text { Change in Per Capita Income }}{\text { Initial Per Capita Income }}\) × 100

Question 16.

State any one determinant of investment.

Answer:

Rate of Interest.

Question 17.

What is the basic cause of inflation?

Answer:

Excess of demand over the supply.

Question 18.

What is balanced budget?

Answer:

When income is equal to expenditure.

![]()

Question 19.

What is deficit budget?

Answer:

When Expenditure of the government > Income of the government.

Question 20.

What is surplus budget?

Answer:

When Income of the government > Expenditure of the government.

Question 21.

Give one example of direct tax.

Answer:

Income Tax.

Question 22.

Give one example of indirect tax.

Answer:

Sales Tax.

Question 23.

Give one example of foreign aid.

Answer:

Foreign loans.

Question 24.

What is soft loan?

Answer:

It is a long term foreign loan with low rate of interest.

Question 25.

What is hard loan?

Answer:

It is a short term foreign loan with high rate of interest.

![]()

Question 26.

State any one objective of monetary policy.

Answer:

Price stability.

Question 27.

State any one objective of fiscal policy.

Answer:

Economic Development.

Question 28.

State any one instrument of fiscal policy.

Answer:

Taxation.

Question 29.

What is meant by domestic factor income?

Answer:

Domestic factor income is the sum of factor income within the domestic territory of a country.

Question 30.

What is meant by ‘normal resident of a country’?

Answer:

A normal resident of a country is defined as a person or institution who normally resides in a country and whose centre of interest lies in that country.

Question 31.

What is meant by ‘net factor income from abroad’?

Answer:

It is the difference between the income received by the residents of a country from abroad and the income paid for the factor services provided by the non-residents in the domestic territory of a country.

Question 32.

What is meant by factor income?

Answer:

Factor income is the income received by the different factors of production for their services in the production process.

Question 33.

What is ‘national income at current prices’?

Answer:

National income calculated by using the current year prices is called national income at current prices.

Question 34.

Define ‘national income at constant prices’.

Answer:

When national income is calculated by using base year prices, it is called national income at constant prices.

Question 35.

What is the relationship between national income at current prices and national income at constant prices?

Answer:

National income at constant prices = \(\frac{\text { National income at current prices }}{\text { Price Index }}\) × 100

![]()

Question 36.

What is the ‘consumption function’ or ‘propensity to consume’?

Answer:

Consumption function signifies the functional relationship between income and consumption. In other words,

C = f(Y)

where C = Consumption and Y – Income.

Question 37.

What type of relationship exists between income and consumption?

Answer:

There is positive relationship between income and consumption.

Question 38.

What are the limits of mar ginal propensity to consume?

Answer:

Marginal propensity to consume lies in between zero and one.

Question 39.

Define saving.

Answer:

According to Keynes, “Saving is the excess of income over consumption.” In other words,

Saving = Income – Consumption.

Question 40.

Define average propensity to save.

Answer:

Average propensity to save is the ratio of saving to income. In other words,

A.P.S = \(\frac{\text { Saving }}{\text { Income }}\)

Question 41.

What is meant by net investment?

Answer:

Net Investment = Gross Investment – Depreciation.

Question 42.

What is meant by replacement investment?

Answer:

Replacement investment is that portion of gross investment that serves to replace the used up or worn out capital investment.

Question 43.

What is voluntary unemployment?

Answer:

A person is said to be voluntarily unemployed if he is not willing to work at the current wage rate.

Question 44.

What is meant by frictional unemployment?

Answer:

Unemployment resulting from the time lags involved in the redeployment of labour is known as frictional unemployment.

Question 45.

What is meant by seasonal unemployment?

Answer:

Seasonal unemployment is the unemployment due to the seasonal nature of activity in some industries.

Question 46.

What is meant by Price Index Number?

Answer:

Price index number signifies a single value with the help of which change is measured in the price/prices of a single commodity or a group of related commodities over a period of time.

Question 47.

What is the basic cause of inflation?

Answer:

When demand exceeds supply, prices start rising and hence inflation arises.

Question 48.

What are the main constituents of money supply?

Answer:

The main constituents of money supply are :

- Currency which includes notes and coins

- Demand deposits.

![]()

Question 49.

What is balanced budget?

Answer:

Balanced budget is that budget in which the income of the govt, equals its expenditure.

Question 50.

What is deficit budget?

Answer:

Deficit budget is that budget in which the expenditure of the govt, exceeds its income.

Question 51.

What is the surplus budget?

Answer:

A budget in which the income of the govt, exceeds its expenditure is known as surplus budget.

Question 52.

Give two examples each of direct and indirect taxes.

Answer:

- Direct Taxes: Income tax and Wealth tax.

- Indirect Taxes: Sales tax and Excise duty.

Question 53.

What is foreign collaboration?

Answer:

Foreign collaboration is one of the forms of foreign capital. Under foreign collaboration, joint ventures are set up by the foreign and the domestic entrepreneurs.

Question 54.

Give two examples of foreign aid.

Answer:

- Foreign loans and

- Foreign grants.

Question 55.

Distinguish between hard-loans and soft-loans.

Answer:

The long-term foreign loans with low rate of interest are called as soft-loans. On the other hand, the short-term foreign loans with’ high rate of interest are called as hard- loans.

Question 56.

What is meant by trade balance?

Answer:

Trade balance signifies the difference between the value of imports and exports of goods, that is, visible items only.

Question 57.

What is meant by unfavourable balance of payments?

Answer:

Unfavourable balance of payments means that the total value of imports of visible as well as invisible items is greater than the total value of exports of visible as well as invisible items.

Question 58.

What are the main objectives of monetary policy?

Answer:

- Price stability

- Full employment

- Economic development

- Exchange rate stability

- Reduction in economic inequalities.

Question 59.

What is meant by bank rate?

Answer:

Bank rate is that minimum rate at which the Central Bank lends money to other commercial banks.

Question 60.

What is meant by open market operations?

Answer:

The sale and purchase of securities in the open market by the Central Bank.

Question 61.

What is meant by liquidity ratio?

Answer:

Each bank has to keep a certain fixed proportion of its total deposits with itself. This ratio is called as liquidity ratio.

![]()

Question 62.

Name the main objectives of fiscal policy.

Answer:

- Economic development

- Price stability

- Exchange rate stability

- Full employment

- Economic equality.

Question 63.

What are the main instruments of fiscal policy?

Answer:

- Taxation

- Public debt

- Deficit financing

- Public expenditure.

Fill in the blanks :

Question 1.

_______ income may be defined as the factor income of the normal residents of a country in one year. (Per Capita / National)

Answer:

National

Question 2.

Use of goods and services produced in order to satisfy human wants is called as __________ (Consumption / Production)

Answer:

Consumption

Question 3.

An addition to ______ is called investment. (Consumption / Capital)

Answer:

Capital

Question 4.

_________ = \(\frac{\text { Consumption }}{\text { Income }}\) (MPC/APS)

Answer:

APC

Question 5.

__________ is defined as the ratio df change in savings to change in income. (MPC / MPS)

Answer:

MPS

![]()

Question 6.

The policy of the government regarding income and expenditure is known as ___________ policy. (Fiscal / Monetary)

Answer:

Fiscal

Question 7.

Creation of utility is called ______________ (Consumption / Production)

Answer:

Production.

III. Multiple Choice Questions :

Question 1.

Destruction of utility is called

(a) Consumption

(b) Production

(c) Exchange

(d) Distribution.

Answer:

(a) Consumption

Question 2.

Give the formula to calculate Per Capita Income. National Income Population

(a) \(\frac{\text { National Income }}{\text { Per Capita Income }}\)

(b) \(\frac{\text { Population }}{\text { National Income }}\)

(c) \(\frac{\text { National Income }}{\text { Population }}\)

(d) None of these

Answer:

(c) \(\frac{\text { National Income }}{\text { Population }}\)

Question 3.

What is the other name of Per Capita Income?

(a) National

(b) Private

(c) Personal

(d) Average.

Answer:

(d) Average.

Question 4.

The policy of the government regarding income and expenditure is known as________policy.

(a) Monetary

(b) Government

(c) Planning

(d) Fiscal.

Answer:

(d) Fiscal.

![]()

Question 5.

Public Income has main aspects.

(a) Two

(b) Three

(c) Four

(d) Five.

Answer:

(b) Three

Question 6.

____________ is the ratio of consumption to income.

(a) APS

(b) APC

(c) MPS

(d) MPC.

Answer:

(b) APC

True / False :

Question 1.

Consumption = Income – Savings.

Answer:

True

Question 2.

Expenditure for further production is known as savings.

Answer:

False

Question 3.

Income tax is direct tax.

Answer:

True

![]()

Question 4.

The policy related with income and expenditure of the govt., is known as fiscal policy.

Answer:

True

Question 5.

Per capita income is also known as Average income..

Answer:

True.

Short Answer Type Questions

Question 1.

Explain the concept of ‘domestic territory of country’.

Answer:

The domestic territory of the country does not necessarily mean the political limit but we include the following in it:

- The area and water which come within the national limit.

- Country’s embassies, military stations, consultancy offices in other countries.

- The airplanes and ships working in other countries.

- Fishing vessels, oil and natural gas rigs, and floating platforms operated by the residents of the country in the international waters.

Question 2.

Distinguish between gross national product and net national product.

Answer:

Gross National Product is the total market value of all the final goods and services produced in a nation in one year.

Net National Product means total of market value of net final goods and services produced in a nation in one year.

Net National Product = Gross National Product – Depreciation of Capital.

Question 3.

Explain the concepts of average propensity to consume and marginal propensity to consume with the help of examples.

Answer:

Average propensity to consume is the ratio of consumption to income. In other words,

A.P.C. = \(\frac{\text { Consumption }}{\text { Income }}\)

Example:

| Income (₹) | Consumption (₹) | A.P.C |

| 200 | 180 | 0.90 |

| 300 | 260 | 0.87 |

When income is 200, Consumption is 180, A.P.C. = \(\frac{180}{200}\) = 0.90. When income increases to ₹ 300, Consumption rises to ₹ 260.

In other words, A.P.C. = \(\frac{260}{300}\) = 0.87.

Marginal propensity to consume is the ratio of change in consumption of the change in income. In other words,

M.P.C = \(\frac{\text { Change in Consumption }}{\text { Change in Income }}\)

Examples:

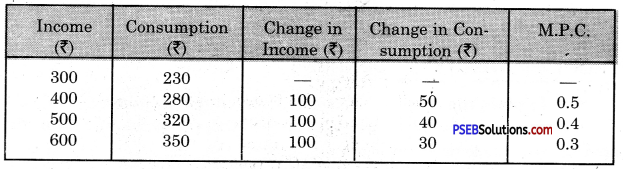

Obviously, when income rises from ₹ 300 to ₹ 400, consumption increases from ₹ 230 to ₹ 280. Therefore, M.P.C. = \(\frac{40}{100}\) = 0.5. Similarly, when income rises from ₹ 400 to ₹ 500, Consumption rises from ₹ 280 to ₹ 320 and hence,

Question 4.

Distinguish between gross investment and net investment.

Answer:

Gross investment is the total production of capital goods in a year. This includes

- Net investment and

- Replacement investment. Replacement investment is that portion of gross investment that serves to replace the used up or worn out capital investment. It refers to the expenditure by the producers on account of depreciation of the fixed capital assets. Thus,

Gross Investment = Net Investment + Replacement Investment.

Net investment is the investment that results in an increase in capital stock. In other words, it is the investment over and above the replacement investment during a given period of time. Thus,

Net Investment = Gross Investment – Replacement Investment.

Question 5.

Distinguish between voluntary and involuntary unemployment.

Answer:

When a worker is not willing to work at the current wage rate, then he is said to be voluntarily unemployed. On the other hand, a worker is said to be involuntarily unemployed when he is willing to work at the current wage rate but does not get work.

![]()

Question 6.

In a state of full employment, what types of unemployment may exist?

Answer:

According to the classical economists, the following types of unemployment may exist even at the stage of full employment:

- Voluntary unemployment

- Frictional unemployment

- Seasonal unemployment

- Structural unemployment

- Technical unemployment.

As a matter of fact, absence of involuntary unemployment signifies full employment in the economy.

Question 7.

Which are the constituents of money supply in India?

Answer:

- Currency, which includes within itself notes and coins.

- Bank deposits.

Question 8.

What is meant by government budget? What are the different types of budget?

Answer:

Govt, budget is a statement of its expected receipts and expected expenditure for the given financial year.

Govt, budget can be of three types:

- Deficit budget. Deficit budget is that budget in which the govt, expenditure exceeds its income. In case of deficit demand, deficit budget is thought to be suitable.

- Surplus budget. That budget in case of which the income of govt, exceeds its expenditure is called as surplus budget. This type of budget is suitable to control excess demand.

- Balanced budget. Balanced budget is that budget in case of which the income of the govt, equals its expenditure.

Question 9.

Give any two merits of direct taxes.

Answer:

(0 Direct taxes like income tax, wealth tax, etc. are based on the principle of ability to pay, so equity or justice in the allocation of tax burden is well secured by these taxes.

(ii) Direct taxes satisfy the canon of certainty.

The State as well as tax-payers are certain about the amount of tax.

Question 10.

Give any two merits of indirect taxes.

Answer:

- Since indirect taxes are collected in small amounts at intervals of time, they are more convenient and less pinching in effect. They are convenient from the point of view of the govt, also, since the tax amount is generally collected from manufacturers or the importers.

- Indirect taxes are generally difficult to be evaded as they are included in the price of the commodity. A person can evade an indirect tax only when he decides not to purchase the taxed commodity.

Question 11.

Discuss about the bank rate and open market operations as instruments of credit control.

Answer:

Bank Rate. The rate at which the central bank lends money to commercial banks is known as the bank rate. By changing the bank rate, the credit and thus the money supply can be affected. With an increase or decrease in the bank rate, the market rate of interest also increases or decreases. Thus with the increase in bank rate, credit becomes dearer and vice-versa. Obviously, when it becomes necessary to control the credit, then the bank rate is increased and when credit is to be expanded, the bank rate is decreased.

Open Market Operation. By open market operations, we mean the sale and purchase of securities in the open market by the Central Bank of the country. If the Central Bank of the country wants to control credit, then it will start selling the securities lying with it. And when it is necessary to expand the credit, then the Central Bank starts purchasing securities from the open market.

Question 12.

Discuss about minimum cash reserve ratio and liquidity ratio as instruments of credit control.

Answer:

Minimum Cash Reserve Ratio. The commercial banks have to keep some percent of their total reserves with the Central Bank in the form of reserve fund. The changes in cash reserve ratio affect the lending capacity of the commercial banks. If credit is to be controlled, then this ratio is increased and if credit is to be expanded, then this ratio is decreased.

Liquidity Ratio. The commercial banks have to keep- a certain fixed proportion of their total reserves with themselves in the form of cash. This is known as liquidity ratio. This amount cannot be lent by commercial banks. If the credit.is to be expanded then the Central Bank lowers this ratio. On the other hand, the liquidity ratio is increased if it becomes necessary to control the credit.

Long Answer Type Questions

Question 1.

Explain common types of unemployment.

Answer:

Following are the common types of unemployment:

1. Voluntary Unemployment. Voluntary unemployment is a situation where workers are not willing to work on prevailing wage rates. In the words of Prof. Dillard, “Voluntary unemployment exists when potential workers are unwilling to accept the going wages or slightly less than going wages.”

2. Involuntary Unemployment. Involuntary unemployment is contrary to the voluntary unemployment. It is a situation in which the workers are ready to work at prevailing wage rates or even less than prevailing wage rates, but they do not get work. In this way involuntary unemployment is forced on the worker. According to Prof. J.M. Keynes, “Involuntary unemployment is a condition in which a person is willing to work at lower real wages than the current real wages whether or not he is willing to accept the lower money wages.”

3. Open Unemployment. In this type of unemployment labourers have not any work to do. He can get even less work. In the lack of work labourers completely remain unemployed. This type of unemployment exists in urban sectors like industrial unemployment and educated unemployment.

4. Seasonal Unemployment. Seasonal unemployment exists due to the seasonal nature of some occupations. For example, agricultural workers get work for few months in a year. Labourers in sugar mills get work from November to April and for other months they remain seasonal unemployed.

5. Structural Unemployment. Structural unemployment exists due to the change in the industrial structure. If we replace old machine for new machine, so during this replacement period worker remain unemployed. This type of unemployment is called structural unemployment.

6. Frictional Unemployment. Frictional unemployment comes into existence due to the mobility of the economy and imperfections in the labour market. In the words of Prof. Dillard, “Frictional unemployment exists when men are temporarily out of work because of imperfections in the labour market.”

Thus frictional unemployment exists in the economy due to immobility of labour in different industries, seasonal nature of some occupations, breakdown of the machinery and ignorance of job opportunities, etc.

![]()

Question 2.

Explain the self-employment and wage generation approach of the government for poverty alleviation.

Answer:

Self-employment and Wage Generation Approach. This approach has been initiated from Third Five Year Plan (1961-66) and enlarged successfully since then.

The following programmes are initiated by the government from time to time under the approach:

1. Food for Work Programme. This programme was launched in the 19706 for the upliftment of the poor. Under this programme, foodgrains are distributed against the wage work.

2. Prime Minister’s Rozgar Yojana (PMRY). This programme has been implemented by the Khadi and Village Industries Commission, which aims at creating self-employment opportunities in rural areas and small towns. One can get financial assistance with bank loans to set up small enterprises under this programme. Under PMRY, the educated unemployed from low-income families in both rural and urban areas can get financial help to set up any type of industry which generates employment.

3. Swarna Jayanti Shahari Rozgar Yojana (SJSRY): This program mainly aims at creating employment opportunities, both self-employment and wage employment in urban areas. Individuals were given financial assistance under the self-employment programme. Now, the PMRY and SJSRY in the 1990s have been changed. Those who wish to benefit from these programmes are encouraged to form Self Help Groups (SHGs) and then the government will provide partial financial assistance through banks.

4. Swarnajayanthi Gram Swarozgar Yojana. Sawamajayanthi Gram Swarbzgar Yojana was launched in April 1999 and is the only self-employment program currently being implemented. It aims at promoting micro-enterprises and to bring the assisted poor families (Swarozgaris) above the poverty line by organising them into Self-Help Groups through the process of social mobilisation, training and capacity building, and provision of income-generating assets through a mix of Bank Credit and Government subsidy. The scheme is being implemented on a cost-sharing ratio of 75: 25 between the centre and the states.

5. Sampoorna Grameen Rozgar Yojana (SGRY). The SGRY was launched in September 2001. The schemes of Jawahar Gram Samridhi Yojana and the Employment Assurance Scheme have been fully integrated with SGRY. The objective of the scheme is to provide additional wage employment along with food security, the creation of durable communities, social and economic assets, and infrastructure development in the rural areas. The scheme envisages the generation of 100 man-days of employment in a year. The cost of the program is to be shared between the centre and the states on a cost-sharing ratio of 87.5: 12.5 (including the foodgrains component).